BC’s Energy Corridor: A Global Energy Hub?

In the vast expanse of Canada’s western frontier, where snow-capped peaks meet the Pacific’s restless waves, British Columbia stands as a linchpin in the nation’s burgeoning energy corridor. This network of pipelines, ports, and power lines isn’t just about extracting resources; it’s a testament to pragmatic ambition, where free-market ingenuity could propel the province into a premier global energy hub. Yet, as we navigate the complexities of infrastructure and global trade, the key lies in fostering development driven by private initiative rather than heavy-handed government dictates. Drawing from historical patterns of economic growth, this editorial explores how BC’s energy aspirations align with core principles of limited intervention and market efficiency, all while acknowledging the practical challenges ahead.

The Strategic Foundations of BC’s Energy Corridor

British Columbia’s emergence as a critical node in Canada’s energy corridor is rooted in its geographical and resource advantages. Stretching from the oil-rich sands of Alberta to the deep-water ports of Vancouver, this corridor facilitates the flow of energy—oil, natural gas, and hydroelectric power—to markets across Asia and the United States. At its core, the corridor represents a blend of infrastructure that enhances global trade, positioning BC not as a mere exporter but as a sophisticated gateway for energy security in an uncertain world.

Historically, regions like BC have thrived when market forces dictate the pace of development. Consider the rapid expansion of the Trans Mountain pipeline expansion, which has doubled capacity to nearly 890,000 barrels per day, largely through private investments that responded to global demand signals [Wall Street Journal, "Canada's Pipeline Push" (https://www.wsj.com/articles/canadas-pipeline-expansion-drives-energy-shift)]. This project exemplifies how market-driven strategies can unlock economic potential without the bureaucratic quagmires that often stifle progress. By emphasizing efficiency and competition, BC can attract foreign investment, create jobs, and bolster traditional values of self-reliance and innovation.

Yet, the corridor’s success hinges on robust infrastructure. Investments in ports, railways, and digital monitoring systems are essential for seamless energy transport. Here, the province’s proximity to Asia-Pacific markets offers a competitive edge, potentially shaving days off shipping times compared to routes through the Panama Canal. As global trade dynamics shift—with nations seeking reliable energy sources amid geopolitical tensions—BC’s role could evolve from regional supplier to indispensable hub, much like how Singapore transformed its harbors into a global trade nexus through savvy, market-oriented policies.

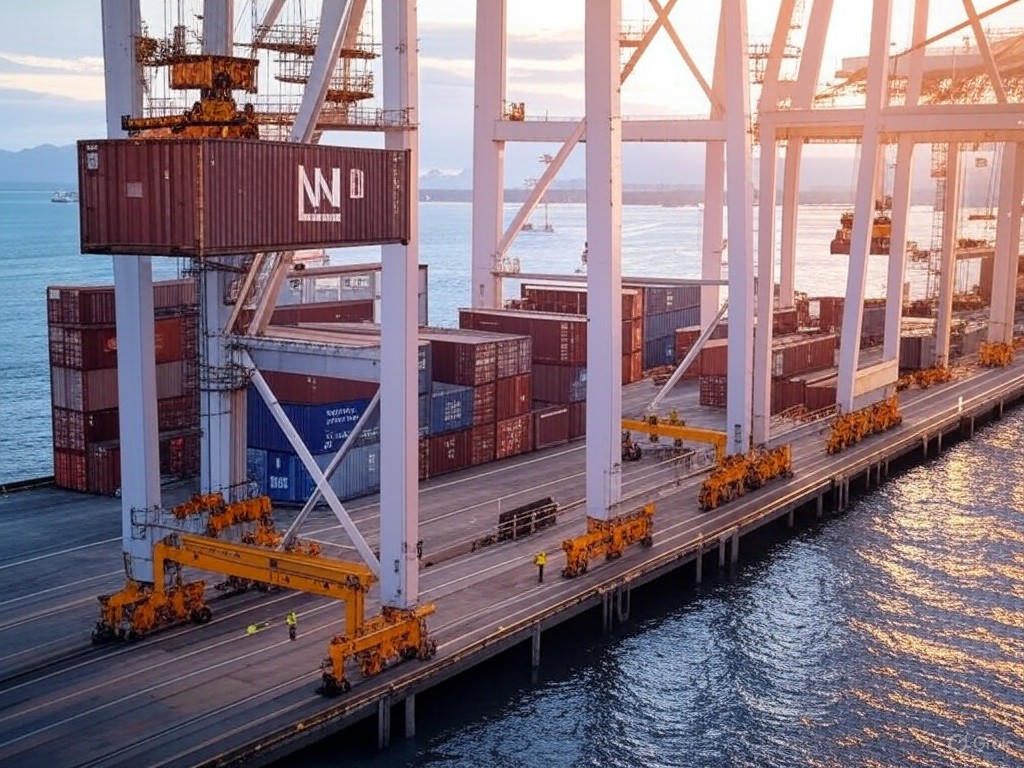

To illustrate this potential, envision the hustle at the Port of Vancouver:  A container ship at the Port of Vancouver loads crude oil for Asian markets, highlighting BC’s pivotal role in bridging North American resources with global demand.

A container ship at the Port of Vancouver loads crude oil for Asian markets, highlighting BC’s pivotal role in bridging North American resources with global demand.

Market-Driven Development: The Engine of Growth

At the heart of BC’s energy ambitions is a commitment to market-driven development, a approach that prioritizes private sector agility over government mandates. This philosophy aligns with center-right tenets, where free markets reward efficiency and innovation, fostering long-term prosperity without the distortions of excessive regulation. In BC, this means leveraging the province’s abundant natural gas reserves and hydroelectric capabilities to meet rising global demand, all while minimizing taxpayer burdens.

Evidence from similar market-oriented models underscores the benefits. For instance, the deregulation of energy markets in the United States during the 1990s led to a surge in production and lower prices, demonstrating how competition can drive down costs and spur technological advancements [Forbes, "The Energy Deregulation Revolution" (https://www.forbes.com/sites/energy-innovation/2023/05/15/the-case-for-market-driven-energy-policies/)]. In BC, adopting a similar stance could accelerate projects like the proposed LNG Canada facility, which promises to export liquefied natural gas to energy-hungry nations in Asia. By allowing market forces to guide investment decisions, BC avoids the pitfalls of subsidies or forced transitions that often lead to inefficiency.

Of course, this path isn’t without hurdles. Environmental concerns and indigenous rights must be addressed through practical, negotiated solutions rather than ideological overreach. Here, the emphasis should be on voluntary partnerships and clear regulatory frameworks that protect property rights and traditional land uses—values that have long underpinned Canadian resource development. A recent analysis by Natural Resources Canada highlights how streamlined approvals for energy projects can reduce delays by up to 40%, provided governments resist the temptation to micromanage [Natural Resources Canada, "Energy Infrastructure Report" (https://www.nrcan.gc.ca/our-natural-resources/energy-sources/energy-infrastructure/23328)]. This balanced approach ensures that development proceeds responsibly, with market incentives encouraging sustainable practices without mandating them from on high.

Amid these discussions, it’s worth pausing to visualize the human element:  Technicians inspect a hydroelectric dam in the BC interior, embodying the skilled labor and market-driven innovation fueling the province’s energy corridor.

Technicians inspect a hydroelectric dam in the BC interior, embodying the skilled labor and market-driven innovation fueling the province’s energy corridor.

Evidence and Challenges: A Pragmatic Assessment

To substantiate BC’s potential as a global energy hub, we must examine the evidence from both economic data and real-world precedents. According to industry reports, the energy corridor could generate upwards of $50 billion in annual exports by 2030, driven by demand from countries like Japan and South Korea [International Energy Agency, "Global Energy Outlook" (https://www.iea.org/reports/world-energy-outlook-2023)]. This growth isn’t merely speculative; it’s grounded in the province’s ability to adapt to market signals, such as fluctuating oil prices, which have historically rewarded flexible producers.

From a center-right lens, the key challenge lies in resisting calls for expansive government intervention. Proposals for blanket carbon taxes or mandatory renewable mandates often overlook the market’s capacity to innovate organically. Instead, policies that encourage voluntary carbon capture technologies—already advancing in places like Alberta—could integrate environmental stewardship with economic viability [IEEE Spectrum, "Advancements in Carbon Capture Tech" (https://spectrum.ieee.org/carbon-capture-innovation)]. By focusing on incentives rather than impositions, BC can maintain its competitive edge, ensuring that energy development aligns with traditional values of fiscal responsibility and individual enterprise.

Nevertheless, skeptics point to risks, such as market volatility or infrastructure vulnerabilities. These are valid concerns, but history shows that free-market mechanisms, like futures trading and private insurance, provide better safeguards than government bailouts. As we’ve seen in the U.S. shale boom, decentralized decision-making led to rapid adaptations during price drops, ultimately strengthening the sector [Wall Street Journal, "Shale's Market Resilience" (https://www.wsj.com/articles/u-s-shale-adapts-to-volatility)]. For BC, embracing this model means prioritizing infrastructure investments that are privately financed and publicly beneficial, rather than relying on state-led initiatives that could burden future generations.

Conclusion: Charting a Steady Course Forward

As British Columbia charts its course in Canada’s energy corridor, the path to global prominence lies in harnessing market-driven development. By fostering an environment where private innovation thrives, the province can enhance global trade, bolster infrastructure, and secure energy supplies for allies abroad—all while upholding the traditional values of self-reliance and prudent governance. This approach not only promises economic dividends but also reinforces the stability that defines strong societies.

Ultimately, the success of BC’s energy ambitions will depend on a balanced commitment to free markets, where government plays a supporting role rather than the lead. As we look to the horizon, with ships laden with BC’s resources sailing toward new horizons, it’s clear that pragmatic, market-oriented strategies will define the province’s legacy. Let’s ensure that legacy is one of enduring prosperity, built not on fleeting trends, but on the solid foundation of economic reality.